Piggybank: A Personal Budgeting App

FINANCE

UI/UX

SnapShot

Timeline

May 2025

Industry

Finance

Role

Lead UX Designer

Team

1 Lead UX Designer

Overview

PiggyBank is a mobile budgeting app designed to help users feel calm, supported, and in control of their finances. Created as part of my graduate UX coursework, the project explores how traditional budgeting tools often fail users not because of missing features, but because they overlook the emotional weight of money management.

Through user interviews, research, and testing, I discovered that many people abandon budgeting apps due to feelings of overwhelm, guilt, and judgment. PiggyBank reframes budgeting as a gentle, judgment-free experience by prioritizing simplicity, emotional support, and clarity. As the sole designer, I led the full UX/UI process, from research and strategy to interaction design, visual identity, and final UI, creating a product that empowers users to build healthier financial habits without stress.

Feel calm and in control of your finances

Budgeting can feel overwhelming when traditional tools are complicated or judgmental. My goal was to create a simple, supportive platform that helps users manage money with confidence and calm.

I began looking to solve a problem with simplifying daily money management

When I started my research, I was focused on how people track their spending and stick to a budget. My initial idea centered around helping users log budget goals and visualize their money in one easy-to-use place.

And then I noticed something surprising

As I interviewed users, they weren’t just frustrated by budgeting tools, they felt emotionally overwhelmed by them. Many described feelings of shame, anxiety, or avoidance, saying they gave up on budgeting altogether because it made them feel judged or discouraged.

Users started sharing their struggles with budgeting apps

And then my perspective shifted…

Real problem: Budgeting feels overwhelming and emotionally draining for many users.

Many people find traditional budgeting apps focus too much on numbers and rules, overlooking the emotional challenges like anxiety and guilt. This often causes users to avoid budgeting altogether or feel discouraged when they slip up. The problem is creating a budgeting experience that supports users emotionally while helping them manage their money confidently.

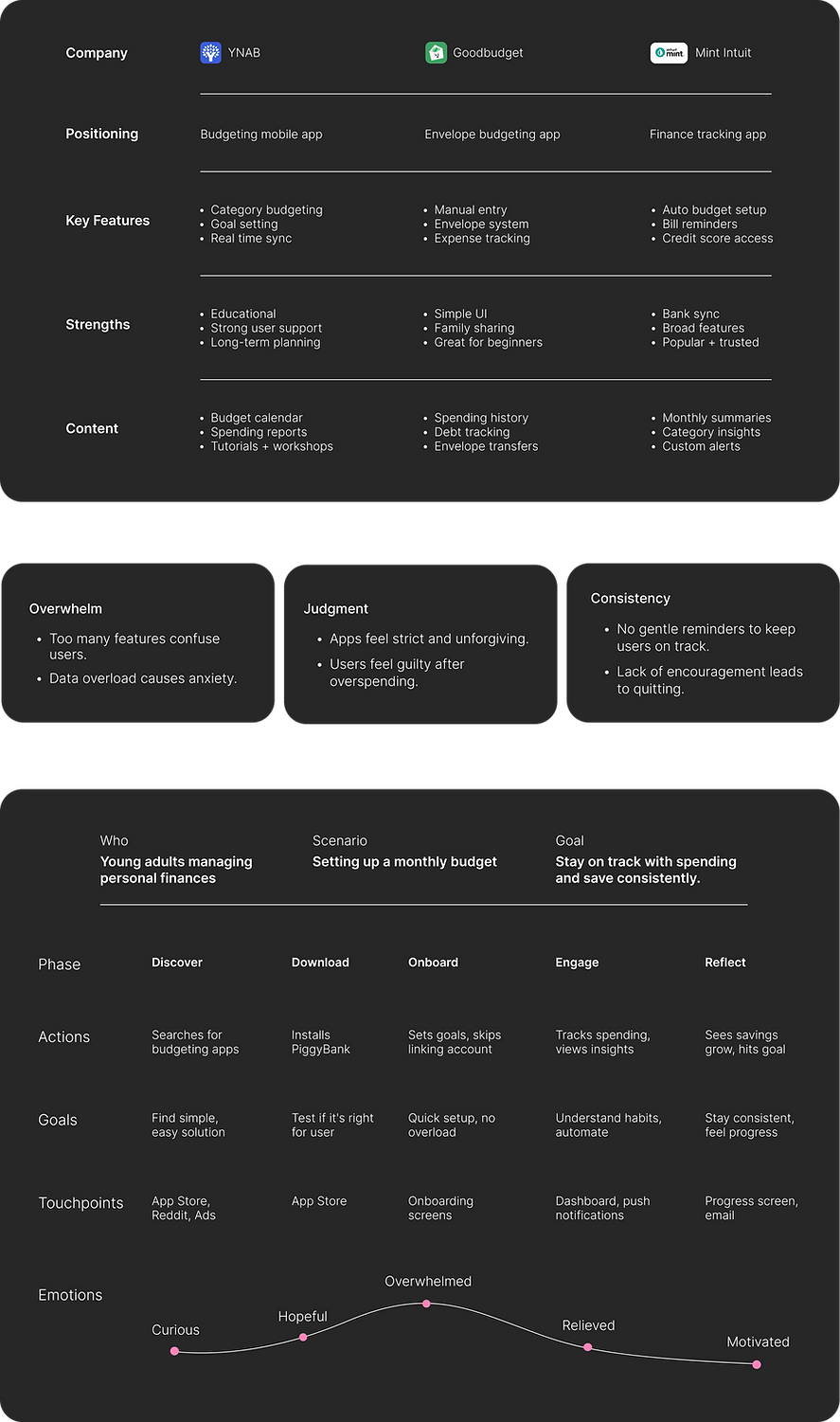

Competitor Apps

Goal: Create a budgeting app that reduces stress and builds confidence through simplicity and emotional support.

The goal was to design a product that helps users feel calm and in control of their finances by offering a judgment-free, easy to use experience. I aimed to develop an app that encourages positive money habits while addressing the emotional barriers that often stop people from budgeting consistently.

Research: Why do users struggle with existing budgeting apps?

The goal was to design a product that helps users feel calm and in control of their finances by offering a judgment-free, easy to use experience. I aimed to develop an app that encourages positive money habits while addressing the emotional barriers that often stop people from budgeting consistently.

Competitive Analysis

Pain Points

Journey Map

Insights

To better understand the frustrations people face when managing their finances, I interviewed a range of users, from young professionals new to budgeting to those juggling student loans and long-term savings. Many shared a common struggle with overly complex budgeting apps, constant manual input, and confusing financial jargon. Patterns emerged around the desire for a more automated, stress-free approach to saving and spending. These insights directly informed the design decisions for PiggyBank, helping shape an experience that’s simple, friendly, and built around real user needs.

User Interviews

Affinity Map

Impact Indicators: How might we help users feel supported rather than judged while managing their money?

The success metrics below focus on concerns I gathered during user interviews regarding the previous platform.

Ideation: Develop a product combining top budgeting features with simplicity and user support.

After uncovering key user needs simplicity, automation, and supportive guidance. I explored a design idea to transform budgeting from stressful to approachable. I focused on solutions that could help users feel supported, automate routine tasks, and provide clear progress insights without overwhelm.

Lo-Fi Sketches

Development: Mid-Fi sketches

After refining my initial ideas, I created a mid-fidelity prototype to explore how PiggyBank could offer users a calm, supportive budgeting experience. This prototype focused on simplifying inputs, providing gentle guidance, and helping users feel more in control of their spending. Testing at this stage helped validate core features and ensure the flow felt approachable and intuitive.

Mid-Fi Wireframes

User Testing

Through user testing sessions, I gathered valuable feedback on my mid-fidelity prototype. Users appreciated the simplicity and automation in the design and liked how personalized guidance was praised but some found it overwhelming. Testing revealed that combining easy automation with gentle, visual encouragement best supports users in feeling confident and judged-free while managing money.

User Testing Key Metrics

Final Design: Develop a calm, supportive budgeting experience that encourages without judgment.

The final design centers on fostering a space where users feel supported managing their money. Features like simple goal tracking, savings budgets, and clear insights help users stay in control and motivated, reducing stress and building confidence.

Bringing PiggyBank to Life

Based on interviews and user testing, it became clear that current financial platforms often lack emotional support and simplicity. Users felt overwhelmed, judged, or unsure of where to start. PiggyBank was designed to shift that experience, offering calm, intuitive tools that guide users through budgeting without pressure. Every element of the final product reflects a more thoughtful and empowering way to manage money.

Branding: Branding that empowers through softness and clarity

The visual identity was crafted to create a sense of ease and emotional safety. Light pink tones paired with rounded corners soften the interface and offer a friendly, non intimidating environment, a deliberate departure from the sharp lines and dark tones typical of finance apps. The design reflects the app’s core values: support, simplicity, and empowerment. Every visual choice was made to help users feel calm, confident, and capable as they take control of their finances.